Gift Vouchers

Connect enables the retailer to sell Gift Vouchers and to give Gift Vouchers as a credit note for returns. This

document explains the process of accepting Gift Vouchers as full or part payment along with the attributed

VAT elements.

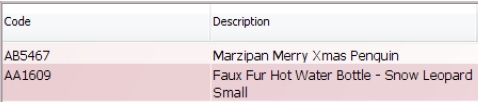

Create a sales transaction.

Enter all products to a Sales Transaction.

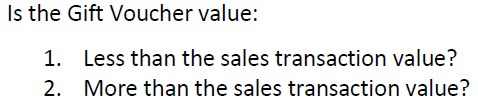

Check value of presented Gift Voucher.

1. GIFT VOUCHER OF LESS VALUE

If the Voucher value is less than the Sales Transaction, scan the barcode on the Gift Voucher.

Scan the Barcode on the Gift Voucher or enter the Voucher Number printed on the Gift Voucher.

As the value received (Gift Voucher) is less than the value of the sales transaction, two payment decision buttons appear.

Click on the button labelled ‘Take further payments Continue‘.

Request the difference from the customer to complete the Sales Transaction.

2. GIFT VOUCHER OF MORE VALUE

If the Voucher value is more than the Sales Transaction:

In order to ensure that the ‘Automatic Voucher Exchange’ function is enabled on each system, you would need to go to the back office, then:

‘Tools’ > ‘Configure’ > ‘Configuration’ > ‘Till Preferences’ > ‘Allow Voucher Exchange’

Please ensure that this field contains a ‘Y’.

Then press ‘OK’, and then restart Connect.

Once this setting is enabled, when processing a sale where the value of the voucher is higher than the value of the transaction;

Scan the voucher’s barcode or enter the voucher code manually, this should then automatically calculate the difference in the total and amount tendered and generate a voucher for the customer with that value.

[su_divider]

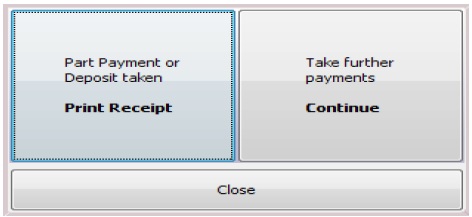

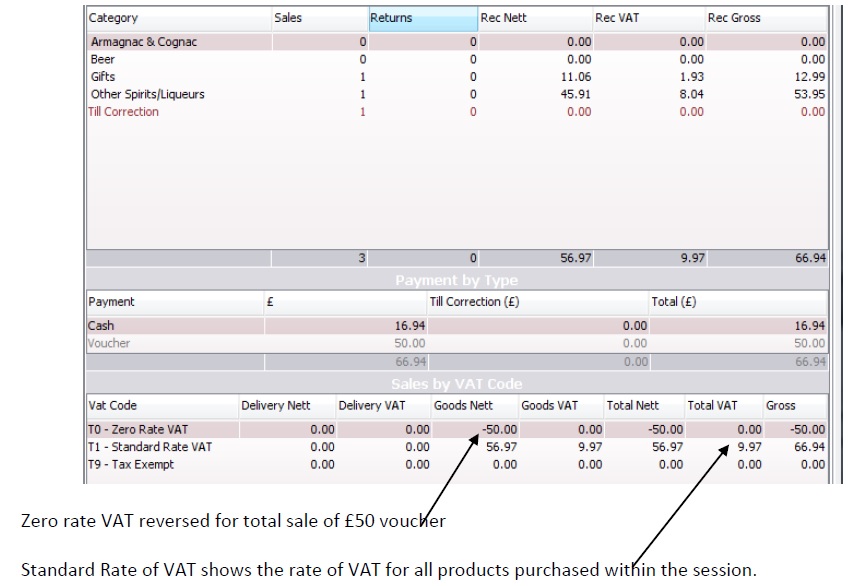

Vat Implications for Gift Vouchers

SELLING VOUCHERS

When vouchers are sold, no VAT is applied. Any sales within a session will show in the top portion of the

Cash Declaration Detail. These will be shown with the sale price of the voucher as zero rated. The bottom

portion of the Cash Declaration Detail for VAT will therefore not show any values.

[su_divider]

Payment by Voucher

When the voucher is redeemed the VAT is attributed dependent upon the articles purchased. i.e. If a zero

rated product is purchased no VAT will be attributed. If however the customer purchases products which

have an element of VAT this will be shown within the session of the date of redemption.

As the value of VAT is attributed upon redemption this will show two lines for VAT on that days’ session, one

to reverse the zero rate VAT and the second to show the VAT for the purchases where applicable.

The value of the voucher will also be seen in the middle section of the Cash Declaration Detail for payment

types.

[su_divider]